Industrial IoT Display Market Size, Share, Statistics and Industry Growth Analysis Report by Technology (LCD, LED, OLED), Panel Size, Application (HMI, Remote Monitoring), End-use Industry (Manufacturing, Energy & Power, Oil & Gas, Mining, Transportation) and Region - Global Forecast to 2028

Updated on : August 11, 2025

Industrial IoT Display Market Size & Growth

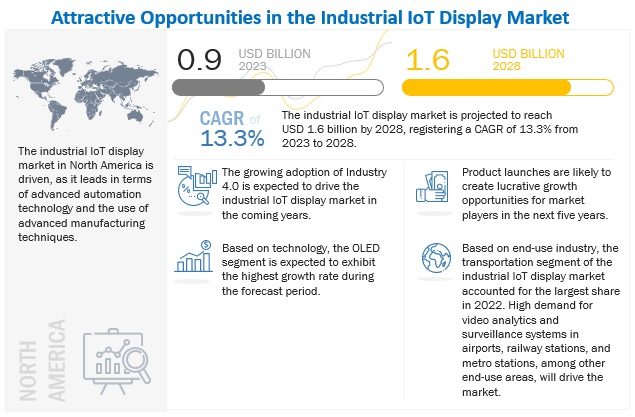

[215 Pages Report] The global Industrial IoT Display Market size is projected to reach USD 1.6 billion by 2028 from an estimated USD 0.9 billion in 2023, growing at a CAGR of 13.3% from 2023 to 2028. The growing adoption of IoT and increasing demand for HMI devices are among the factors driving the growth of the Industrial IoT Display market.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial IoT Display Market Trends :

Driver: Rising emphasis on real-time data analysis and predictive maintenance

With the advent of technologies, such as the Industrial Internet of Things (IoT), predictive analytics is becoming more intelligent and empowering the manufacturing vertical. Along with the rising demand, manufacturers are using the capabilities of predictive analytics to enhance their production abilities. Countries such as the US and China have used predictive analytics to improve manufacturing at a global scale. There will be a prominent use of predictive analytics solutions in the manufacturing vertical for predictive maintenance, asset management, and remote monitoring applications.

Rapid developments in the global manufacturing industry are leading to strong competition in the manufacturing sector. Manufacturers across all end-use industries, such as oil & gas, F&B, automotive, and A&D, are constantly seeking solutions to help them obtain better visibility of manufacturing plants to enhance efficiency.

The convergence of robotics, artificial intelligence, and big data analytics has the potential to lead to significant improvements in productivity, efficiency, and cost reductions. IIoT creates a universe of sensors, allowing for faster deep learning of existing operations. These data technologies enable rapid contextualization as well as automated pattern and trend recognition.

Restraint: High installation and maintenance costs

The installation cost of industrial IoT displays and HMI systems is high, which acts as a major restraint for the growth of the market across Asia Pacific, the Middle East & Africa, and South America, which are among the cost-sensitive markets. The high installation cost of industrial IoT displays and HMI systems is due to the involvement of various stages, such as consultation, acquisition, implementation, and running costs, that further increase the expenditure of the installing company.

The introduction of smart manufacturing has resulted in the adoption of advanced industrial automation equipment, such as smart field devices and industrial robots. To communicate with these types of equipment, the displays and HMIs need to be more advanced with the latest functional technologies such as voice recognition, gesture recognition, and multi-touch screen, which further increases the cost of the system. These technologies are still quite expensive and may lead to an additional financial burden on industries operating in price-sensitive economies.

Opportunity: Growing demand for digital signage in industries

Industries have witnessed an increase in the adoption of digital signage in manufacturing and oil & gas applications. Digital signage displays such as industrial-grade touchscreen monitors, interactive touchscreen signage, and interactive display systems are used in different industrial environments based on the end application and use.

Digital display solutions, such as production display boards and other information displays, are used to improve employee engagement and interaction, deliver accurate information, transmit internal communications, display integral real-time data for lean production, and others. Digital signage systems in manufacturing application can increase awareness among workers toward their safety, alert workers to supply-chain concerns, and help reduce response time related to production quality issues. Digital signage displays also help eliminate or reduce print publishing and, in turn, eliminate wastage. Digital signage in manufacturing application acts as long-term engagement solution and is, therefore, expected to witness high adoption in the coming years.

Challenge: Increasing security risks associated with cloud–HMI platform

Cloud-IoT displays are gaining popularity as they can reduce initial costs, provide easy access, and quick deployment. However, security concerns associated with cloud computing are a major concern for end users. On a cloud-based platform, many customers can use the same service, which raises issues of data vulnerability. It is risky to share critical business information with third-party service providers, as information leaks can cause huge losses to the company. Furthermore, increasing occurrences of viruses and hacking lead to security concerns. The entire information flow could be disrupted if cloud service providers do not implement proper security measures. A majority of vulnerabilities in IoT displays and HMI are related to memory corruption, poor credential management, and code injection bugs, lack of authentication, and insecure defaults—all of which are preventable by improving the security.

By technology, TFT-LCDs to cater to the largest share

TFT-LCD technology held the highest share of the industrial loT display industry in 2022. TFT LCDs utilised for industrial lot displays have a wide range of features. They are extremely robust and are utilised in harsh settings. They have good visibility in a variety of indoor and outdoor environments. They are constructed with high-quality industrial-grade components and materials to withstand harsh testing such as ESD, EMI, and ageing. Their more than ten-year lifespan makes them extremely popular. LCDs are utilised in a variety of applications, including automotive, digital signage, medical and industrial displays, and electronic book readers. TFT-LCDs are in high demand in a variety of areas, including manufacturing, healthcare, transportation, and consumer electronics.

More than 20” panel size is expected to record the highest CAGR in the forecast period

The more than 20” panel size category held the largest share of the industrial lot display market in 2022. During the forecast period, it is also expected to grow at the fastest CAGR. Large panel displays are commonly utilised on the plant floor to display production status. High-resolution industrial monitors and video walls are commonly used in the oil and gas sector to analyse seismic imaging data. They are utilised in the transportation, manufacturing, and healthcare industries, as well as for learning, presentations, signs, and navigation.

Transportation segment accounted for the largest share of the Industrial IoT Display market in 2022

In 2022, transportation accounted for the largest share of the industrial IoT display market. The increasing adoption of video analytics and surveillance systems in airports, railway stations, and metro stations, among other end-use areas, is one of the key factors driving the transportation segment. The growing use of smart cameras for traffic monitoring, as well as for incident detection and reporting applications, is also contributing to the growth.

Industrial loT Display Market Regional Analysis

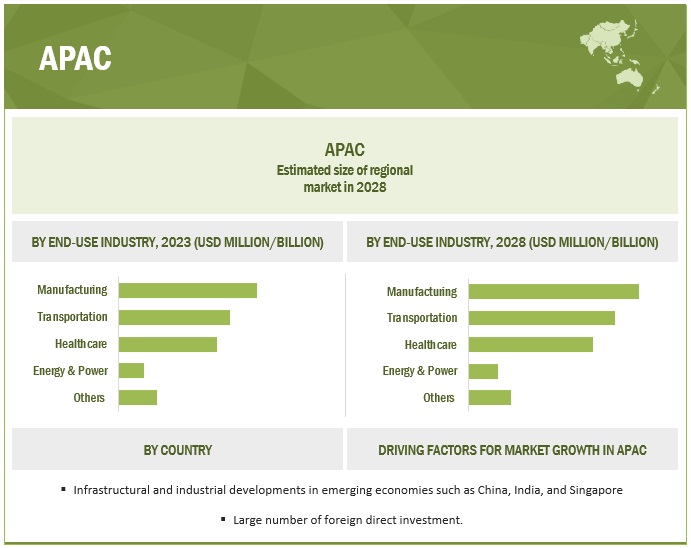

By 2028, Asia Pacific is projected to grow with the fastest CAGR in the forecast period

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is expected to record the highest CAGR during the forecast period. Asia Pacific is evolving as a global manufacturing hub as key Asian countries, such as China, India, and Singapore, have adopted a make-in-Asia initiative. For instance, the ‘Made in China 2025’ government initiative provides high-tech industries, such as robotics and AI, subsidies, low-interest loans, rent-free land, and tax breaks. Singapore is also heavily investing in industrial IoT as part of the country's Smart Nation initiative. Thus, the adoption of industrial IoT for remote monitoring and predictive maintenance in various end-use industries has aided in driving the industrial IoT display market size in Asia Pacific.

Top Industrial IoT Display Companies - Key Market Players:

The Industrial IoT Display companies such as

- E Ink Holdings Inc. (Taiwan),

- BOE Technology Group Co., Ltd. (China),

- Advantech Co., Ltd. (Taiwan),

- Pepperl+Fuchs SE (Germany),

- Sharp Corporation (Japan),

- PDi Digital (Austria),

- Planar Systems, Inc. (US),

- Winmate Inc. (Taiwan),

- Maple Systems Inc. (US)

Industrial IoT Display Market Report Scope :

|

Report Metric |

Detail |

| Estimated Market Size | USD 0.9 billion in 2023 |

| Projected Market Size | USD 1.6 billion by 2028 |

| Growth Rate | CAGR of 13.3% |

|

Industrial loT Display Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Companies Covered |

E Ink Holdings Inc. (Taiwan), BOE Technology Group Co., Ltd. (China), Advantech Co., Ltd. (Taiwan), Pepperl+Fuchs SE (Germany), Sharp Corporation (Japan), PDi Digital (Austria), Planar Systems, Inc. (US), Winmate Inc. (Taiwan), Maple Systems Inc. (US), American Industrial Systems Inc. (AIS) (US), Panasonic Corporation (Japan), Innolux Corporation (Taiwan), Display Technology Ltd (UK), LG Electronics (South Korea), Samsung Electronics Co., Ltd. (South Korea), Riverdi Sp. z o.o. (Poland), Melrose Systems (US), DKE CO., LTD. (China), Glide Technology Pvt. Ltd. (India), Schneider Electric (France), Kingtech Group Co., Ltd. (China), Crystal Display Systems Ltd (UK), Pervasive Displays, Inc. (Taiwan), Emsol Automation Pvt Ltd (India), and SENECA S.r.l. (Italy) are some of the key players in the Industrial IoT Display market. |

This research report categorizes the Industrial IoT Display market based on technology, panel size, application, end-use industry, and region.

Industrial IoT Display Market Share & Segments :

Based on Technology

- TFT-LCD

- LED

- OLED

- E-Paper display

Based on Panel Size

- Less than 10”

- Between 10”and 20”

- More than 20”

Based on Application

- Human Machine Interface

- Remote Monitoring

- Interactive Display

- Electronic Shelf Labels

- Others (Digital Signage, Imaging, Video Walls)

Based on End-Use Industry

- Manufacturing

- Healthcare

- Energy & Power

- Transportation

- Others (Oil & Gas and Mining)

Industrial loT Display Market Size, Based on Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- Taiwan

- Rest of Asia Pacific

-

Rest of the World

- Middle East

- Africa

- South America

Recent Developments in Industrial IoT Display Industry :

- In September 2022, Advantech Co., Ltd. introduced two new UTC-500 series products: the UTC-515I and 520I. They are all-in-one touch PCs with 15.6-inch and 21.5-inch screens, new platform technology, and improved serviceability. The fanless cooling architecture of the UTC-515I/520I enables the system to endure deployment in tough ambient circumstances while also extending the product lifespan by eliminating dust and debris collection inside the system. To fulfill the needs of industrial and commercial situations, its IP65-certified front panel protects against water and dust.

- In September 2022, Planar launched a fine pitch, high brightness outdoor LED video wall optimized for up close viewing to its range of outdoor fine pitch LED display solutions. The coated LEDs of the Planar Luminate Ultra Series LED video wall display provide robustness and high image detail in high-ambient light conditions.

- In September 2022, 2021, Planar launched a fine pitch, high brightness outdoor LED video wall optimized for up close viewing to its range of outdoor fine pitch LED display solutions. The coated LEDs of the Planar Luminate Ultra Series LED video wall display provide robustness and high image detail in high-ambient light conditions.

Frequently Asked Questions (FAQ):

Which are the major companies in the Industrial IoT Display market? What are their major strategies to strengthen their market presence?

The major companies in the Industrial IoT Display market are – E Ink Holdings Inc. (Taiwan), BOE Technology Group Co., Ltd. (China), Advantech Co., Ltd. (Taiwan), Pepperl+Fuchs SE (Germany), Sharp Corporation (Japan), PDi Digital (Austria), Planar Systems, Inc. (US), Winmate Inc. (Taiwan), Maple Systems Inc. (US). The major strategies adopted by these players product launches, and acquisitions.

Which is the potential market for Industrial IoT Display in terms of the region?

North America region is expected to dominate the Industrial IoT Display market. Constant efforts are being made in North America to enhance the adoption of industrial IoT displays for HMIs, digital signage, interactive displays, remote monitoring, and others. Thus, the market for industrial IoT displays in North America is expected to grow soon.

Which are the key drivers supporting the growth of the satellite IoT market?

Companies such as E Ink Holdings Inc., BOE Technology Group Co., Ltd., Advantech Co., Ltd., Pepperl+Fuchs SE, Sharp Corporation, fall under the winner’s category. These companies cater to the requirements of their end users by providing various IoT displays for HMI, remote monitoring, interactive displays, ESLs and others.

What are the drivers and opportunities for the Industrial IoT Display market?

Factors such as rising demand for HMI devices and Growing adoption of IoT are among the driving factors of the Industrial IoT Display market. Moreover, integration of advanced technologies with display to create lucrative opportunities in the Industrial IoT Display market.

Who are the major end-use industries of Industrial IoT Displays that are expected to drive the growth of the market in the next 5 years?

The major end-use industries for Industrial IoT Display are transportation, and healthcare are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size of the Industrial IoT Display market size . Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering Industrial IoT Display have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the Industrial IoT Display Industry . Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of Industrial IoT Displays to identify key players based on their products and prevailing industry trends in the Industrial IoT Display market share by panel size, technology, application, end-use industry, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

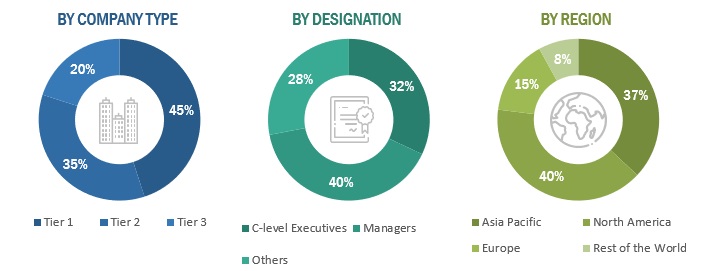

Extensive primary research has been conducted after understanding and analyzing the current scenario of the Industrial IoT Display Industry through secondary research. Several primary interviews have been conducted with the key opinion leaders from demand and supply sides across four main regions—North America, Europe, Asia Pacific, Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been employed to arrive at the overall size of the Industrial IoT Display Industry trends from the revenue of key players and their market shares

- Identifying the number of Industrial IoT Display shipped at the global level

- Identifying average selling prices of Industrial IoT Display shipped globally

- Conducting multiple discussion sessions with key opinion leaders to understand different Industrial IoT Display wafers and their deployment in applications; analyzing the break-up of the work carried out by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases, of the company- and region-specific developments undertaken in the Industrial IoT Display Industry

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the total size of the Industrial IoT Display market share.

In the top-down approach, the overall size of the industrial IoT display market share has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

To analyze the size of specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has been implemented for the data extracted from the secondary research to validate the market size obtained.

Each company's market share has been estimated to verify the revenues used in the bottom-up approach earlier. The overall size of the parent and individual markets have been determined and confirmed in this study through the data triangulation method and data validation through primaries. The data triangulation method utilized in this study has been explained in the next section.

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the size of the industrial Internet of Things (IoT) display market based on technology, panel size, application, and end-use industry in terms of value

- To describe and forecast the size of the market based on application in terms of value and volume

- To describe and forecast the size of various segments of the market for four main regions: North America, Asia Pacific, Europe, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities for the stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and provide a detailed competitive landscape of the market

- To analyze strategic approaches adopted by the leading players in the market, including product launches/developments and acquisitions

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial IoT Display Market